It’s Tuesday, and today we’re discussing Gigmile, a financing solution for gig workers based in Ghana. Founded by Kayode Adeyinka and Samuel Esiri, the company recently closed a seed financing round led by ENZA Capital, with participation from Seedstars International Ventures and Norrsken Africa Fund. And while I was writing this article, the company additionally secured a strategic investment from Yango Ventures.

The Context

Today we’re going to talk about the gig economy of two countries: Nigeria and Ghana.

While the numbers are sparse, we do know that the gig economy has been scaling quickly in both countries, as well as across Africa more broadly. Uber and Bolt have been active in both markets for roughly a decade. Yango entered Ghana in 2021, Glovo launched in both countries in 2021, and inDrive expanded into Nigeria in 2019 and into Ghana in 2022. In 2022, Nigeria alone had 26 active ride-hailing companies, up from just two in 2014. In Ghana, between 250,000 and 300,000 people are engaged in gig work. If we extrapolate that figure to Nigeria’s population, that would imply somewhere between 1.38 million and 1.65 million gig workers.

With all this absolute growth is happening, both countries are experiencing driver shortages. This results not only in longer waiting times, but also in higher prices. In Nigeria, for instance, prices jumped by 92% between 2018 and 2021. Some of that increase was likely driven by inflation, but driver shortages clearly played a role as well.

The reasons behind these shortages differ. Safety concerns are one factor, as driving in some areas may not be safe. But one of the most important structural constraints is simpler: many potential drivers do not have the capital required to purchase a vehicle of any type. With per capita incomes in Ghana and Nigeria hovering around $3,000 and $1,000 respectively, it’s not hard to see why vehicle ownership is out of reach for most.

The obvious alternative is credit. But for most people in these markets, that option doesn’t really work either. In India, a country at a broadly comparable development level to Nigeria and Ghana, around 75% of two-wheeler purchases are financed. In Ghana, by contrast, only about 16% of riders finance their vehicles. Insurance is another major barrier. In Nigeria, only about 25% of vehicles are insured. In Ghana the situation better, with around 60% penetration, but that is still far from universal coverage.

What ultimately blocks many potential gig workers from accessing loans is a reinforcing combination of informal work, lack of collateral, loan underperformance, and high interest rates. Here’s how it all fits together:

Inability to guarantee a loan. For many workers, the only collateral they can offer is the bike or vehicle they are trying to finance in the first place. Banks and other lenders are understandably cautious about extending credit to those customers. But some still do, which leads to…

Loan underperformance. Between 10% and 18% of loans are non-performing (NPL). Gig work is often seasonal, and workers operate with very thin margins. Missing even a single week of work can lead to a default, because consistent daily income is required just to service the loan. Which leads to…

Another option could be renting. However, here the issue is that gig workers already operate on tight margins, and adding rental payments on top of existing costs depresses those margins even further. There’s both no wealth accumulation and no option to own the vehicle in the future.

For people who want to enter gig work, or for those already working but struggling to stay afloat, the solution needs to do two things at once:

Allow them to own a vehicle in a financially manageable way.

Provide access to stable and predictable employment opportunities.

⠀Gigmile is trying to address both of these constraints at the same time.

The Product

Gigmile is a fintech platform that helps gig workers access vehicles and participate in the digital economy. It targets both individuals and mobility providers, but I discuss mobility providers only in the context of gig workers.

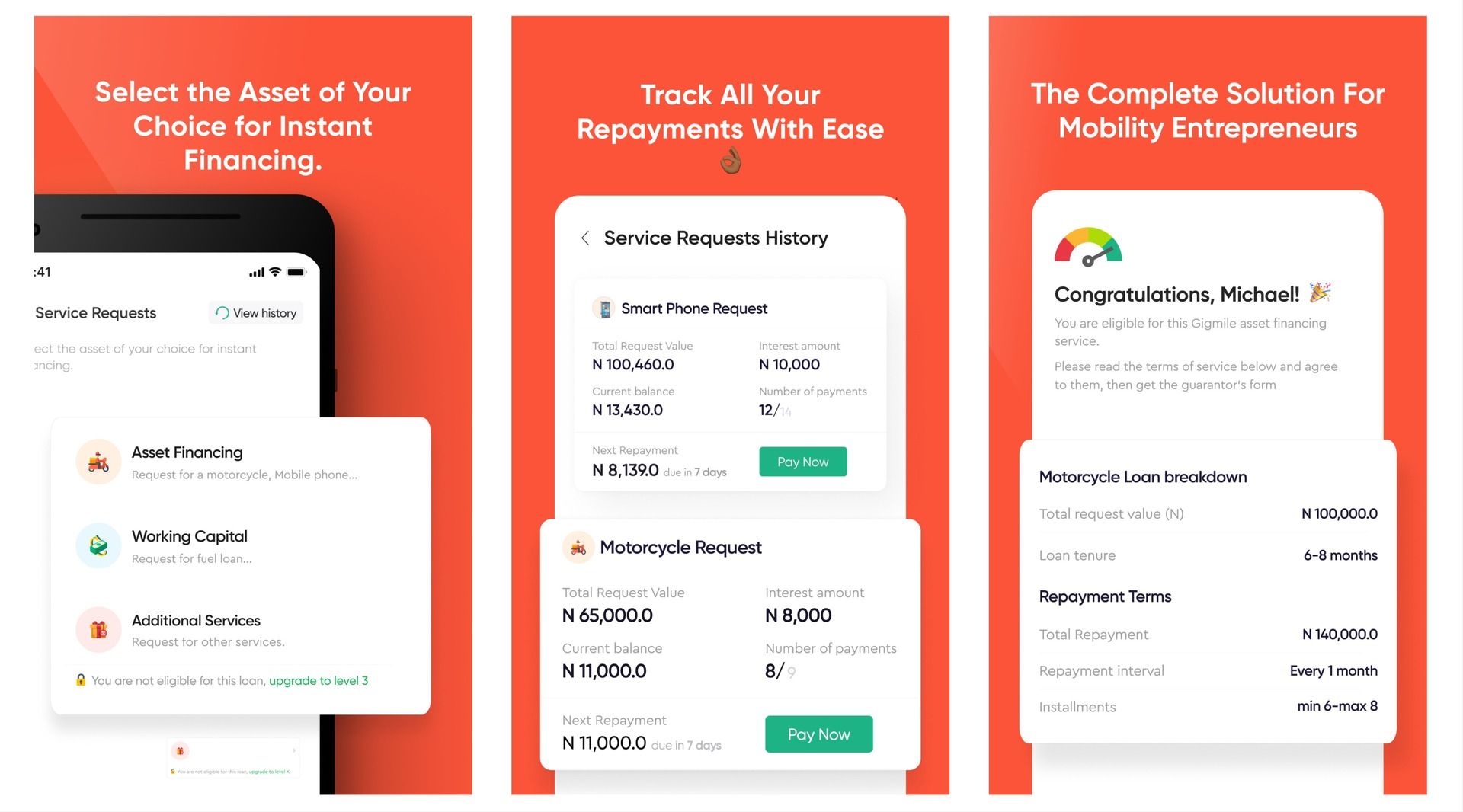

At its core, the offering is fairly simple. Gigmile supports its users throughout their gig work journey, but everything it provides is ultimately built around financing. You can think of Gigmile’s product as operating across three stages.

Stage #1: Onboarding

When a new user registers in the app, they can request what the company calls “income-generating assets.” These include motorcycles, tricycles, cars, and even smartphones needed to take on orders. I’ll go deeper into the model later, but for now it’s worth noting that vehicles are provided under rent-to-own or lease-to-own arrangements. As part of a packaged deal, Gigmile also handles licensing and regulatory documentation, as well as insurance.

On the insurance side, the company reports a 35% reduction in health-related expenses among riders. Which is a lot, especially when you take into account the fact that only about 3% of Nigerians are covered by any form of insurance.

Source: Google Play

When a new rider joins the platform, they also participate in onboarding sessions. These sessions explain how contracts and repayments work, how riders can qualify for future financing, and how to use gig platforms more effectively. Riders learn how to access jobs, how to interact with customers, and what basic professional etiquette looks like in practice.

Stage #2: Finding work

Gigmile connects gig workers with “income-generating opportunities.” These can include logistics providers, ride-hailing companies, food delivery platforms, and even local merchants. While the company initially focused on two- and three-wheelers, in 2024 it expanded into cars through a partnership with Yango. Today, Gigmile riders operate on platforms such as Yango, Bolt, Uber, Glovo, Jumia, Chowdeck, and Gokada.

While Gigmile’s native app does not allow riders to search for orders, it works the other way around.

Here’s what I mean. Suppose you are a logistics provider looking to increase your number of riders. You can use Gigmile to identify riders registered on the platform who may be interested in joining your service as well. In this scenario, everyone benefits: you gain riders, riders gain more job opportunities, and Gigmile improves its unit economics (more on that shortly).

Stage #3: Support

This is, at its heart, a financing business. And financing is inherently risky, especially in markets that are not deeply accustomed to formal debt. Any lender operating in this context needs to build trust. And that phrase is often used loosely, and usually without much substance behind it.

In Gigmile’s case, however. Communication with riders doesn’t stop after onboarding. As the company explains in its impact report:

Riders remain connected through refresher sessions, town halls, and community events that encourage peer learning and continuous improvement. In this way, the Academy becomes less of a one-time training and more of a long-term support system.

Through town halls, drivers share negative experiences, discuss what could be improved, and surface practical issues they face on the job. Gigmile also organizes bi-monthly football matches and runs a driver-of-the-month program. Each month, five winners are selected, with rewards ranging from food supplies and fuel coupons to mobile phones.

Each driver is also assigned to a captain manager. This person is responsible not only for ensuring timely repayments, but also for helping riders resolve day-to-day issues that might otherwise escalate into defaults.

Whether they do this because they genuinely care, because they know it is the only way their model can work, or for both reasons, is not for me to decide—and in any case, it is beside the point. What matters is that they are taking concrete steps to cultivate trust, which helps them: a) demonstrate that their model works, and; b) onboard more riders, with 60% of riders joining through a referral program 1.

Now, finally, let’s get to the model part.

The Business Model

The main threat to sustainability in any credit-based business is non-performing loans.

To reduce that risk, Gigmile does not issue traditional loans. Instead, it relies on rent-to-own and lease-to-own structures, and it ties repayments directly to the active use of the asset. The more a vehicle is used, the faster the repayment progresses.

To better understand how it all works, we have to answer two questions: how Gigmile underwrites risk, and how it ensures that financed assets are actually being used.

Underwriting

Most riders cannot provide collateral, so Gigmile uses a set of behavioral signals to assess applicants. These include how quickly a rider submits required paperwork, whether they are willing to pay an onboarding fee, and whether they need repeated reminders to complete onboarding. On top of that, the company has introduced psychometric testing to build a deeper profile of prospective clients.

Beyond these more formal indicators, Gigmile also relies heavily on human judgment. The company leans on community-based vetting by speaking with cooperatives, people who refer the rider, and the rider themselves.

Unlike traditional underwriting, Gigmile obtains much more context about the individual. By leveraging the social network (in a literal sense), they can understand not just how a person behaved in the past, but why they did so. For instance, if someone repaid a previous loan, was it under duress, or do they always pay their debts no matter what? While more time-consuming, this approach to underwriting is a better predictor of future repayments.

Ensuring asset usage

To further reduce default risk, Gigmile relies on telematics, embedded payments, and consistent engagement, which I mentioned earlier. By monitoring drivers closely, both through digital signals and at a human level, Gigmile can quickly determine whether a rider’s current behavior may result in default: is asset usage consistent, are there late payments, and so on.

By providing access to maintenance, cheaper insurance, and support through managers and community events, Gigmile helps riders feel supported. Support builds trust, and the greater that trust, the less likely riders are to undermine it.

Monetization

The company makes money in three ways.

The primary revenue stream is asset financing, with interest rates of up to 4% per month with daily repayments capped at 1/3 of the rider’s expected income.

In addition, the company offers microcredit for expenses such as fuel and maintenance, where interest rates can reach up to 7% per month. Finally, Gigmile collects 5% platform fees from both riders and the digital platforms they work with.

Results

Today, Gigmile operates in 13 cities across Ghana and Nigeria. The company has deployed around 8,500 vehicles with a combined value of $18 million. Across roughly 7,850 active vehicles, onboarded riders generate about $2 million in gross earnings, with some riders increasing their income by as much as five times compared to what they earned before joining the platform.

The Bear Case

To scale further, meaning to purchase new vehicles that can then be financed to riders, Gigmile has to continuously raise capital. At scale, this should become a relatively stable and profitable business. Any disruption to the digital economy, whether driven by a macroeconomic crisis or by new regulation, hits Gigmile. The company depends on riders being active, using the assets daily. Any slowdown in deliveries or ride-hailing activity directly impacts repayment stability.

In a worst-case scenario, Gigmile would be forced to repossess vehicles. That process has operational costs, and it leaves the company holding depreciated assets in a market where demand is already under pressure.

Both Nigerian and Ghanaian economies rely on commodity exports, and those markets are inherently unstable, which adds to the risk profile, since shocks there will inevitably affect the broader economy.

The Bull Case

Because of how it approaches building its business, Gigmile has one crucial thing going for it. The company has been able to build trust in its offering and in how it operates. That trust results in 60% of new riders joining through recommendations, which unlocks: a) stable CAC, because referral payments are fixed; b) a network effect in a business that usually isn’t enhanced by one. This is not a classic network effect, because costs aren’t going down and there are no real scale economies here. However, more riders beget more riders, which increases Gigmile’s revenue, if not necessarily its profitability.

The company has achieved a 95% asset utilization rate and therefore has lower default rates compared to the industry average. If that main factor sustains, there are several ways the company can expand:

Enter new countries, with many African markets sharing similar fundamentals.

Launch new products that increase rider activity and repayment reliability, such as fuel wallets or roadside assistance, or other financial products, like savings accounts.

Combine these network effects with expansion, and there is a lot of untapped potential here.

The Takeaway

Is it just me, or is the utilization-driven model becoming more popular? And is this happening only in emerging markets, or in established ones as well?

If you liked this post, subscribe to Geography & Tech! Every Tuesday we dive into overlooked startups from around the world.