Hello dear reader,

It’s Thursday, and today we’re discussing Purple Elephant Ventures (PEV)—a venture studio creating sustainable solutions for African tourism industry.

PEV, a Kenyan-based venture studio focused on the tourism industry, raised $4.5 million in seed funding. Clear Creek Investment B.V. and Klister Corp. are among the backers.

The Product

I usually cover traditional startups but made an exception for PEV because of its geography-specific focus.

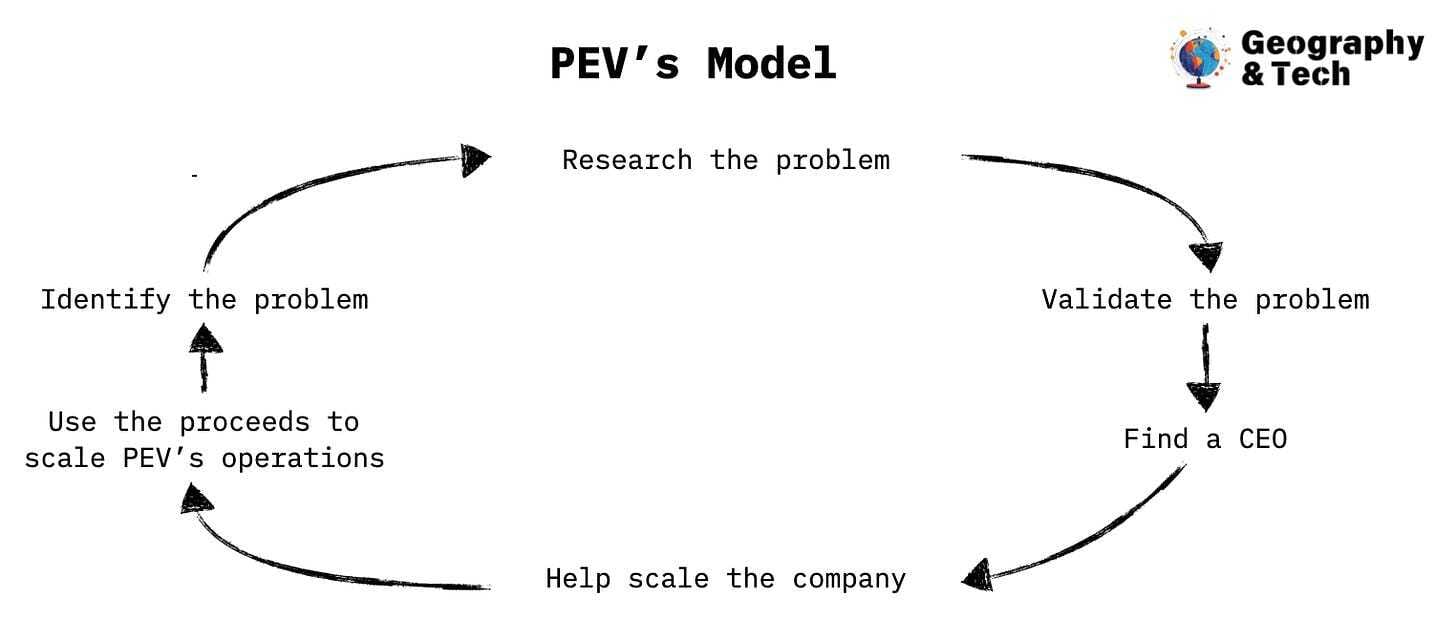

PEV claims to be the world’s first tourism-focused venture studio. It identifies a problem in sustainable tourism in Africa, assesses its viability, builds an MVP, recruits a CEO, and acts as a co-founder.

PEV currently has five startups:

Nomad Africa: A content-to-commerce travel agency specializing in high-end East African experiences.

Zafari: Booking software that includes website building and payment management tools.

Kijani Supplies: Supplies sustainable products for safari camps, from fresh produce to appliances.

Powertrip: Sells energy-efficient appliances priced competitively with traditional alternatives.

Join Africa: Helps national parks with animal tracking, speed management, queue management, and more.

What’s fascinating, PEV also mentions its failed ideas and why they didn’t work.

For instance, there was Fika Rooms—a distributed hotel model for Africa’s secondary cities. due to insufficient near-ready supply and skeptical future funding. Similarly, Anthill Services, launched during COVID-19 to support tourism operators, struggled because no guests meant no funds.

The Business Model

Let’s start with PEV as a fund, and then move to specific businesses. PEV operates as a holding company with equity stakes in its startups.

When PEV hires a CEO for a business, that CEO gets equity in the company. The CEO then finances operations of the business through revenue, external funding, or debt from PEV. PEV profits through dividends or by selling its stake.

A notable detail about the studio’s strategy is that each business is designed to launch with less than $250,000, achieve solid unit economics at low volumes, and generate revenue quickly—an approach that allows for both high IRR and scalability.

Now, let’s move to PEV’s businesses:

Nomad Africa: Started as a media company making money through ads, now earns by selling travel packages with content marketing driving customer acquisition.

Zafari: The company chose a model that’s becoming more common in the software world. While most SaaS businesses charge a fixed monthly price, Zafari is free and has a revenue-sharing model and takes a cut of direct bookings.

Kijani Supplies: A wholesaler that sources supplies from brand partners and sells to lodges. It also offers financing, likely earning interest. True to PEV’s sustainability ethos, Kijani focuses on eco-friendly supplies and aims to build a carbon-neutral supply chain.

Powertip: From what I understand, connects customers with energy-efficient appliance suppliers, helping reduce energy bills and improve margins. It also provides post-sale customer service, enhancing value for clients

Join Africa: Here, unfortunately, the business model is not as clear. Based on very limited information online, but the model might involve a one-time service fee and potentially a software product for tasks like queue management. But I could be totally wrong on this one.

The Local Angle

PEV’s businesses currently operate in Kenya, catering to the local market, but the company has its eyes on Africa as a whole. So, let’s look at both Kenya’s tourism scene and the continent’s broader context.

An Industry with Incredible Potential: Demand is growing: by 2030 Kenya may host 5 million tourists, up from 2.5 million in 2024. For Africa those numbers are 134 million and 74 million respectively. However, when PEV started, only a handful of startups in the region raised over $100,000, so there’s very little competition.

Removing Inefficiencies: PEV’s portfolio tackles inefficiencies head-on. For example, 80% of bookings in Africa still go through travel agents, who take an average 30% commission. Many lodge owners want to sell directly to clients but don’t know how—this is where Zafari steps in with a Shopify-like solution. Marketing is another big problem: many operators struggle to promote their properties effectively. Nomad Africa addresses this through its content marketing services.

Solving for Real Issues: Kenya’s wildlife service manages 8% of the country’s territory, and three of the ten countries with the most land dedicated to national parks are in Africa. Wildlife viewing attracts 61% of Kenya’s tourists and 80% of Africa’s. But with a rapidly expanding population and continued industrialization, sustainability challenges take center stage. PEV’s portfolio demonstrates how innovation can tackle both massive, continent-wide issues and more localized ones. For instance, Powertrip addresses the critical problem of energy consumption by making businesses more energy-efficient—key to combating Africa’s growing energy demand. Meanwhile, Join Africa focuses on solving a more specific issue: overcrowding in Kenya’s national parks, particularly during the busy summer season.

Currency Advantage: Kenya’s shilling has steadily weakened against the US dollar. While bad for imports, this boosts exporters, especially the tourism industry, making Kenya a more affordable destination for international visitors.

The Roadblocks

Challenges for PEV largely stem from the opportunities they aim to capture. To oversimplify, there’s a lot of potential, but the foundations to support growth are still shaky.

Expanding the Team: PEV’s founder, Ben Peterson, highlighted the region’s limited access to talent, which hampers growth. This could both slow down the development of new opportunities and strain existing operations.

Underinvestment in Tourism: According to data from Crunchbase, Since 2020, only 11 Kenyan tourism startups have raised funding, according to Crunchbase. Across Africa, just 41 companies in this sector have raised venture capital, and none surpassed PEV’s total funding of $5.5 million. While less competition is good, the lack of infrastructure and proven models creates fundraising challenges. On one hand, this means less competition. On the other hand, it also means less infrastructure to support emerging startups. Plus, there’s less evidence for investors that a particular idea could succeed—there aren’t examples, not just in Kenya but across the continent. This creates significant challenges when it comes to raising funding.

Instability, Disease Outbreaks and other Issues: Kenyan security forces killed 65 people during protests last year, according to rights groups. Meanwhile, 75% of the population is at risk for malaria. Even basic things like transportation are a hurdle—it takes at least eight hours to reach Nairobi from any developed country. And that’s if you have a direct flight. Trips to Kenya don’t come cheap either: a one-day safari will cost at least $100, but from what I’ve look at a $200–$300 is more typical. So a one-week trip could easily exceed $2,000. All that puts a cap on how big the industry could get.

Accelerating the Adoption Curve: On one hand, low digitization, like with the Zafari example, presents a massive opportunity: a huge untapped market with no competition. But it also means you’re stuck with the heavy lifting—explaining the value of software and teaching people how to use it. In the most developed software market in the world, the U.S., 74% of businesses use a CRM. Sounds like a lot, right? But only 50% of companies with fewer than 10 employees have one. And it’s not like the 26% who don’t use a CRM have no clue they exist. Long story short: selling a new solution in a new market is hard.