It’s Tuesday, and today we’re talking about Tractor Junction, an Indian tractor marketplace. Founded by Animesh Agarwal, Shivani Gupta, and Rajat Gupta, the company recently raised a $22.6 million Series A round led by Astanor, with InfoEdge Ventures and Omnivore also participating.

The Context

The following stat sits somewhere at the very top of the “unknown and a bit shocking” category.

In 2024, India produced 1.04 million tractors, which means the country is responsible for roughly half of global tractor supply. Even accounting for the fact that India is the second-largest agricultural producer in the world and has 46.1% of its workforce employed in the sector, that number is still impressive.

Despite this seemingly massive market, there are still significant barriers to buying tractors, both new and used. As a result, only between 5% and 9% of farmers actually own a tractor.

Source: Dvara Research

Barriers to Buying New Tractors

For new tractors, the problems farmers face are primarily about price. The most popular tractor models cost between $8,000 and $12,000. Rural households, meanwhile, earn around $130 per month. So atractor costs at least 5.6× the annual household income.

Financing does exist, but a lot depends on the required down payment. Some banks offer loans with 15% down payments, while others go as high as 40%. Depending on location and loan duration, financing terms vary widely. Even at 15%, the down payment alone is roughly equivalent to a full year of income for a typical farmer. On top of that come insurance, registration, and other additional costs.

The final point on the price is dealer control. Evidence here is murky, but it appears that individual dealers are responsible for single territories. In practice, that means dealers have local monopolies, which can lead to discriminatory pricing.

Now, 86% of holdings are under 2 ha, meaning the vast majority of farmers are smallholders. And that means that they can’t really afford to buy a brand new vehicle. This leaves used tractors as the only viable option, creating an even bigger market: around 1.5 million used tractors are sold each year.

Barriers to Buying Used Tractors

Financing issues still exist in the used market, but they are less severe since older models are cheaper.

The bigger problem is that the market itself is not formalized. Buy-sell transactions happen in small secondhand tractor markets. These markets are not regulated, there is no government body overseeing them, and as a result they exhibit the same issues common to informal markets:

Intermediaries: agents who match buyers and sellers and take a 1–2% commission on the transaction.

High financing costs: financing is provided by Arthiya, commission agents in grain markets, who charge interest rates of around 18%.

General disorganization: farmers complain about a lack of basic infrastructure such as sufficient space, toilets, water, and other facilities.

Lack of guarantee: the agent acts as the guarantor, with written affidavits mandating payments, and most transactions are conducted in cash. None of this inspires confidence in a country already lacking trust more broadly.

Low-quality information: sales agents may be incentivized to push specific tractors, resulting in farmers buying machines with the wrong horsepower or unsuitable specifications.

I want to hammer on the trust issue in particular. A lot happens in the secondhand tractor market that actively undermines any sense of trust. There are gangs filing fake theft complaints, generating fake registration certificates, and selling tractors in markets across other states. There are scammers promising farmers a tractor loan and then disappearing with both the tractor and the down payment. There are even websites promoting fake government subsidy programs for tractor purchases.

Someone has to step in and organize the mess. That someone might very well be Tractor Junction.

The Product

Tractor Junction is a three-sided marketplace connecting buyers of tractors and farming equipment with dealers and individual sellers. The platform offers both new and used tractors and equipment. New products are supplied by dealers, while used products are listed by other farmers.

Now, let’s take a closer look at the value each party gets from joining the marketplace.

Farmers

First and foremost, farmers get transparency. They have access to a catalog featuring thousands of options, with detailed listings, a large volume of content explaining different models, and visible pricing and financing options.

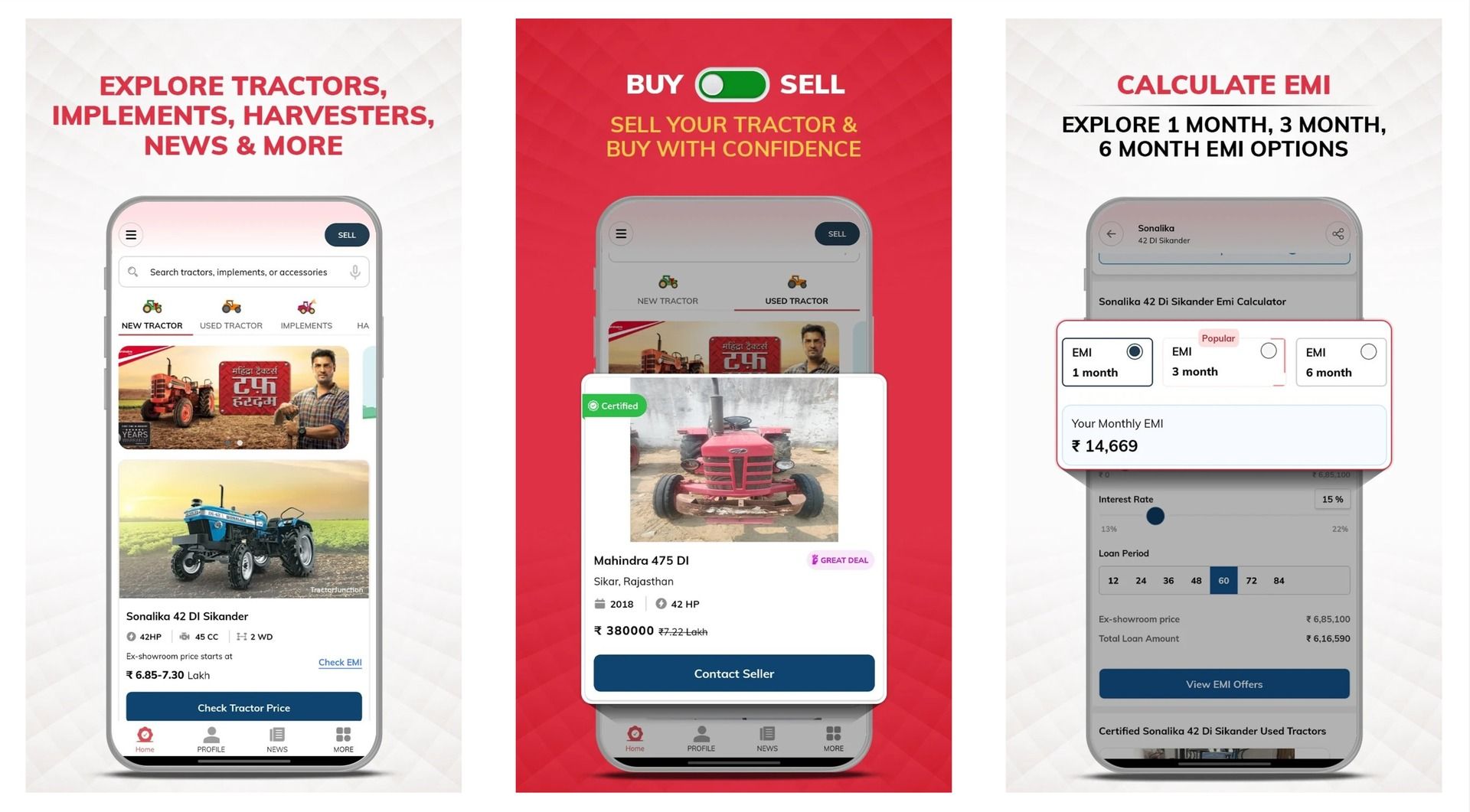

Source: Google Play

Because of the trust component, Tractor Junction could not function as a purely digital marketplace with no physical presence. According to Animesh Agarwal:

Even in urban communities, to buy such a high-ticket item without physical inspection is not happening. So to expect the rural community to build that level of trust is not possible, at least in the foreseeable future.

Partly for this reason, the company operates 77 dedicated showrooms across six states. Farmers can filter by the nearest showroom and physically inspect the vehicle before buying. Another reason is simply that this customer base is largely offline. So physical presence is necessary for discovery, and it makes economic sense, as 70% of showroom sales come from walk-ins.

Buyers also get access to financing and insurance, which are critical for two reasons:

70% of tractor purchases are made on credit, meaning that without credit offerings you lose 70% of potential customers.

60% of Tractor Junction’s buyers are new to credit, which enhances the company’s ability to build long-term customer relationships, assuming loan terms are better than what customers can access elsewhere.

Digitization also broadens access. Instead of one or two financing providers available at a local market, farmers can access dozens of banks, receive multiple offers, and choose the option that works best for them.

Dealers

For dealers, the value proposition is as simple as expanding reach. They incur no additional costs, and it is unlikely that Tractor Junction will monopolize demand. This is very different from say Amazon, where brands that partnered early effectively gave up the opportunity to build their own online distribution.

In tractor commerce, we are likely decades away from online being comparable to offline sales. At worst, dealers get their brand in front of thousands of prospective buyers. In the best case, they get an actual customer.

Individual Sellers

Farmers who want to sell their tractor or other equipment face the same trust issues as buyers. On top of that, finding a buyer in a remote village is difficult. There may be a market nearby, but that still requires transporting the tractor there.

Logistics is an even bigger problem when selling farm equipment. Your tractor is often the only way to move that equipment from point A to point B.

New Category Expansion

Tractor Junction did not stop at tractors and farming equipment. It expanded into new categories, first trucks, then construction equipment, and later bikes and cars. With the exception of cars, each category has already scaled to hundreds of thousands of monthly visitors.

While the value proposition in these newer verticals is not as clear clear and I feel like there’s not much differentiation, they still generate incremental revenue for the company.

The Business Model

While on the surface Tractor Junction looks like a marketplace with some physical locations, the company actually operates three distinct business lines:

Platform: the core marketplace where buyers are connected with sellers. The main task here is demand generation, creating enough buyer interest for supply to come.

Commerce: these are company-operated stores. Tractor Junction buys, refurbishes, and sells tractors directly, offering a six-month warranty.

Fintech: the financing arm of the business, which provides loans to buyers. Here the objective is similar to the platform: generate enough volume and traffic for banks to have an incentive to participate.

All three business lines are powered by the company’s content engine. According to Similarweb, Tractor Junction’s main site generates around 1.5 million monthly visits, and that figure does not include the mobile app or other properties. On the website, the company publishes content closely tied to farmers’ lives, including news, articles about agricultural equipment, and guides on choosing the right tractor for specific needs. Tractor Junction also operates a YouTube channel with more than 700,000 subscribers.

This full-scale content marketing program enables two things. First, it builds trust, as buyers become familiar with Tractor Junction long before they make a purchase. Second, it generates leads, either by directly driving users to the platform or by keeping the brand top of mind. A farmer may research tractors, go away for a few months, and then return to Tractor Junction when the actually decide to buy.

By solving for transparency through content, a broad assortment, and clear pricing, the company is able to layer additional offerings on top of the core marketplace.

Monetization

Three business lines have three distinct ways of making money:

Platform — lead generation and ads. Seelling warm, verified leads to dealers. Additionally, the company sells banner ads to same dealers.

Commerce — asset margin. Profit generated from the difference between the buying price and selling price of used tractors.

Fintech — success fees. Commissions from banks for every loan processed and disbursed through the platform.

Results

In FY2025, revenue nearly doubled to $13.65 million, with the company aiming to reach $113 million in ARR within two years. Over the past three years, Tractor Junction sold around 7,000 tractors, including 4,000 in the last year alone. Roughly 90% of these sales came through the platform, with the remaining 10% generated by the commerce business. To date, the company has facilitated $169 million in loan disbursements.

The Bear Case

Unlike a traditional marketplace business, Tractor Junction is not asset-light. The company buys and stocks tractors, and tractor and equipment logistics are challenging, especially in rural areas. That requires a significant amount of working capital. But the offline presence is necessary to sustain the perception of a real, trustworthy business, even when the buyer never actually visits a physical location.

For the platform side of the business, AI presents a real threat. Collecting, structuring, and presenting information about a specific product is one of the most obvious use cases for AI, and that is a large part of how Tractor Junction drives traffic today.

Another challenge is that most of the company’s business lines are unlikely to be either high-ticket, high-margin, or both. Advertising is often the most attractive business model for marketplaces, but India’s advertising market is still nascent. In the short to medium term, the upside there is limited.

Finally, the company’s desire to sell everything from tractors to cars, effectively operating multiple category-specific websites, gives me pause. Focus sometimes has a downside, but more often than not, it’s the thing you should do.

The Bull Case

It is hard to say how far Tractor Junction is from becoming a trusted seller of everything related to farming, but that is the core bull case. The company becomes the place to buy and sell tractors online. It is growing quickly and plans to expand into new states. Its content engine continues to generate significant value, and as long as the company can scale both its online and offline presence while improving its digital infrastructure, it has a shot at becoming the starting point of the discovery journey, instead of Google or ChatGPT.

Both physical locations and the online platform create opportunities for product expansion. Physical locations can serve as points where farmers buy inputs or additional equipment, while the platform has effectively infinite shelf space, so it goes without saying that you can expand assortment there.

The Takeaway

What’s the one lesson investors and founders can take away from Tractor Junction?

There are still thousands upon thousands of niches to build a business on a strong content marketing foundation, especially in emerging markets where there’s both low trust (which content helps address) and where LLMs are unlikely to make your content obsolete tomorrow.