It’s Tuesday, and today we’re covering Yamify, an AI infrastructure startup based in DR Congo. Founded by Luc Okalobé, the company just raised a $100,000 pre-seed round.

The Context

The pace of technological change keeps accelerating, and most of us expect that the speed at which humanity conceives and deploys new technology will only increase with the rise of AI.

But just like during previous technological shifts, Africa risks being left behind. The continent isn’t a single market, but many of its countries face the same core issues: limited computing power, a shortage of skilled developers, and scarce resources to build and deploy AI systems at scale.

Now, let’s get specific.

The challenges African companies face when trying to run AI workloads can be divided into tech-related and non-tech-related ones.

Tech-related Challenges

Roughly 10% of the world’s internet users live in Africa, yet the region hosts less than 1% of global data-center capacity. Most major cloud providers are only now starting to set up local regions on the continent. This gap creates three direct problems:

High latency, which affects applications like chatbots that rely on instant responses.

High data-transfer costs, since much traffic still travels through Europe before returning.

Severe GPU scarcity, which limits local model training and testing capacity.

Without accessible, affordable GPUs, fewer than 10% of African startups can afford the compute power needed to build or run AI models.

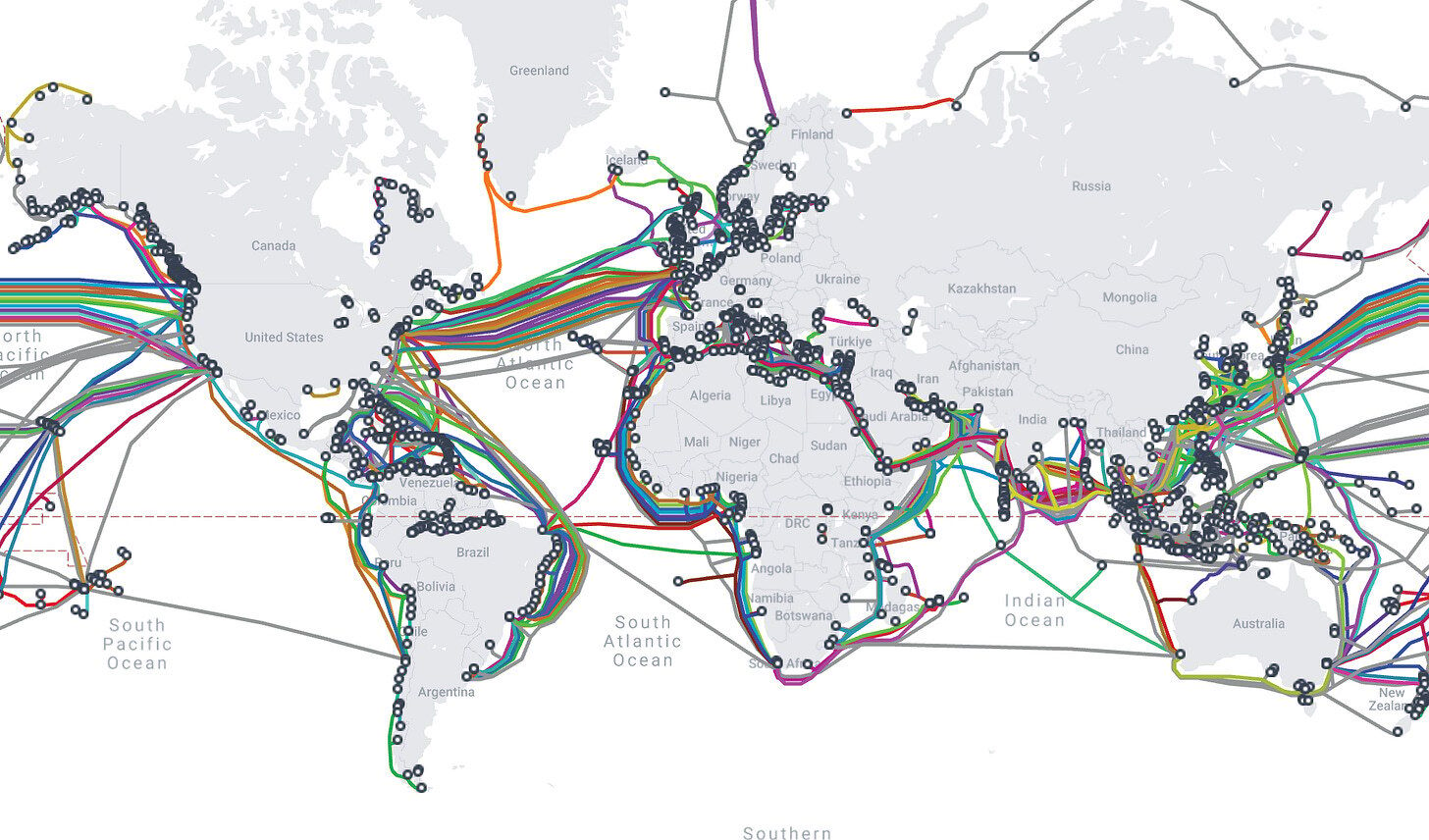

Even if capacity improves, connectivity problems remain. The issue isn’t necessarily a lack of undersea cables, Africa has plenty, but rather uneven local IXP (Internet Exchange Point) coverage and a shortage of cross-border fiber connections. The World Bank estimates that another 250,000 km of terrestrial fiber are needed to reach universal broadband coverage. That means that even if two users or servers are in the same country, their traffic can still be routed all the way through Europe before connecting.

This dependence on a few key submarine cables introduces another risk. In 2024, a rockslide damaged four cables off the coast of West Africa, cutting or slowing internet access in 13 countries. Beyond reliability, studies show that localizing IXPs doesn’t just make the internet faster, it also saves tens of millions of dollars annually by reducing international traffic costs.

Then there’s the skills gap. According to McKinsey, 97% of African organizations expect ongoing tech talent shortages. What’s more, the talent that exists is highly concentrated. A Google report found that 41% of all professional developers in Africa are based in just three countries: South Africa, Egypt, and Nigeria.

Finally, top AI and cloud certifications typically cost between $300 and $1,000, while many developers across the continent earn around $300 a month. And even those who manage to get certified often still struggle to deploy models in real-world settings due to a lack of hands-on, production-grade environments.

Non-tech-related Challenges

Beyond the infrastructure and talent gaps, there are macro and operational hurdles that make AI adoption difficult.

Many major African economies experience sharp currency swings and high inflation. Egypt, for instance, saw the pound fall by around 40% in 2024 following a rate hike, while Ghana faced inflation above 50% in 2022 before gradually stabilizing. Because cloud services are usually priced in USD, these shifts make compute even more expensive. For a startup paying for cloud GPUs abroad, costs in local currency can rise 40-50% overnight, while revenue stays the same. Combine that with the inherently high cost of running AI workloads and limited pricing power in local markets, and it’s very hard to see the economics working for most startups.

Another issue is payments. Customers across Africa use different payment rails depending on the market: cards in some, mobile money (like M-Pesa or MoMo) in others. And it’s not like AWS offers M-Pesa payments. Beyond convenience, this creates reliability issues. In Nigeria, for example, international naira card payments were suspended for three years due to severe dollar shortages, so there was no reliable way for businesses to pay for international services.

Regional economies are also moving towards stricter data protection laws. For instance, South Africa, Kenya, and Nigeriaare all limiting cross-border data transfers in one way or another, which affects compliance costs for local startups. While I don’t think this is a massive hurdle for most companies today, it could become one in the future if the infrastructure is not localized.

The Product

Yamify is planning to democratize AI infrastructure by building a hosting platform for open-source AI tools.

The offering is built on several building blocks:

Open source. It is pre-loaded with AI frameworks (PyTorch, TensorFlow, Hugging Face), allowing users to import a model or start training immediately.

User-friendly. t also includes ready-to-use apps like n8n, a drag-and-drop tool for building workflows (for example, taking a message, running it through a model, and sending a reply), so users can get something working quickly without managing servers.

Localized GPU clusters. The company calls them YAMs. Workloads are run on GPUs in local data centers, with hosting in Nigeria, Congo, and South Africa, and cloud providers serving as backups.

Local-currency billing. Users can pay in local currencies and through local payment methods such as M-Pesa or MTN MoMo.

AI tutors. To help users acquire skills faster, the company is deploying AI tutors that adapt to individual learning speeds.

Model Context Protocol (MCP). The company is also building an MCP to help developers quickly move from an idea to a functional AI prototype.

Taken together, there are three core value unlocks.

The first stems from the fact that it’s open source and there’s no developer lock-in, which allows for greater flexibility and cost savings.

The second has to do with localization (currency, GPUs). Here again, users benefit from cost savings, lower latency, and easier data-residency alignment.

Finally, adding and pre-loading ready-to-use apps lowers barriers to entry, so teams that don’t have cloud specialists can start using Yamify’s environments immediately.

The Business Model

The company is just starting out, but the main theme that stands out is its focus on developers.

That’s probably the only viable path to growth at this stage—given limited funding and ambitious goals, Yamify has to build from the bottom up.

Obviously, on the technical side everything revolves around open source and the idea of freedom from vendor lock-in. Developers can move their workloads elsewhere if they choose, which makes adoption less risky. On the commercial side, the approach is equally developer-centric. The company’s sales strategy relies on being present in developer communities, hackathons, and similar grassroots environments. While traditional cloud providers focus on large enterprises, Yamify’s audience is freelancers, small agencies, and early-stage startups.

According to Okalobé: “We go after people who don’t know AWS exists. We help them launch their first chatbot or automation and grow with them.”

There are also smaller but I would say thoughtful touches, like automatically turning off idle workflows to reduce costs and deploying AI tutors to help users learn faster. Essentially, the company is starting by creating an environment where barriers to entry are as low as possible so that more developers can be brought into the ecosystem.

Monetization

Yamify launched its private beta this past summer, so monetization is still in its early stages. The company offers a free tier for testing, a $15 monthly plan for individuals, and a $500 plan for agencies. Over the next six months, it plans to onboard around 100,000 users.

The Bear Case

It’s a difficult balance to strike: scaling a platform that targets smaller customers while still needing expensive hardware and developer support to grow. Unlike enterprise clients, small businesses and freelancers don’t bring in much revenue individually, so you need a large number of them to make the model work. On top of that, churn can be high as projects are often short-lived, and many of these users will require more technical support. All of this creates substantial operating costs, and and it’s not yet clear whether Yamify will have enough capital to sustain that growth.

Then there’s the question of the product. Whether developers actually care about open source is debatable, but most developer environments today are massive walled gardens. It may also be that what the market really wants is a no-code platform. Something that directly solves the skills gap.

The Bull Case

On the one hand, you have Yamify building a grassroots following. On the other, there are cloud providers focused on developed markets. This creates an opportunity for it to somewhat counter-position its offering (although we’re veeeery far from that). But if the company manages to nurture this grassroots support, it’ll be able to convert it into loyalty.

Since no large provider is targeting Africa, Yamify can grow with its customers, offering built-in advantages like local currency billing right from the start. As those customers scale, Yamify scales, and can layer on more services over time—until it eventually realizes the vision of becoming Africa’s default AI infrastructure platform.

The Takeaway

Here’s a small thought I had while writing this. It’s never been cheaper to build something on the internet, yet never more expensive to build the technology that actually powers the internet.