It’s Tuesday, and today the hero of our story is YaVendió, a Peru-based startup automating e-commerce on WhatsApp. The company recently raised a pre-seed round from Magma Partners, iThink VC, and Semilla Ventures.

The Product

YaVendió is an AI-powered virtual sales assistant automating online selling through WhatsApp. Its product works as an end-to-end “conversational storefront” for businesses, managing the entire sales process. The startup mainly partners with businesses selling physical goods—think fashion, footwear, and beauty.

So instead of setting up a WhatsApp Business storefront and manually managing everything, you just hand that task over to AI.

That’s the product in a nutshell. But why would you even need it?

YaVendió’s founder, David Tafur, previously worked at Belcorp—a company primarily selling beauty products through direct sales.

They experimented with sending customers direct links to their catalog, but it didn’t work so well. Why? Because the approach lacked the personal connection that salespeople traditionally create, whether in person or through WhatsApp.

As David puts it, the salesperson didn’t just sell; they also asked about your friends, your husband, and so on. It was a very human type of sale—a very “Latin sale.”

But how can you replicate this personal touch digitally, without an actual human involved?

This is where the AI steps in.

The company consistently emphasizes that their product is not meant to replace humans, nor is it a basic chatbot or traditional software product.

It’s a full-fledged AI sales agent capable of managing the entire sales journey—from the first interaction to payment—without needing human input:

It’s not a simple automation tool—it actively guides the client through the sales process, answering questions and nudging them toward making a purchase.

It’s content agnostic—it seamlessly handles text, audio, photos, and videos.

It’s flexible—it operates beyond predefined scripts, handling complex queries smoothly.

It can upsell or cross-sell—it sends personalized promotions and timely reminders.

It’s adaptable—it adjusts to each store’s style, communicating in different tones or even varying sentence lengths.

Unlike a traditional chatbot, it understands context better and interacts in a non-linear way. Unlike a human, it scales infinitely and operates 24/7.

To date, the company has helped over 120 brands in Mexico and Peru increase sales by 30%, while simultaneously cutting operational expenses by 80%. More than 100,000 customers have chatted with the sales agent. Aside from Mexico and Peru, YaVendió also operates in Chile and Ecuador.

The Business Model

YaVendió occupies an interesting niche in the e-commerce value chain.

On one hand, it serves as an extra sales channel, similar to a website, generating direct sales for businesses.

On the other hand, it can significantly reinforce existing sales channels like websites. Imagine a scenario: a customer finds a dress on a company’s website, hops over to WhatsApp to ask a few questions, interacts with YaVendió’s AI, and ultimately completes the purchase right there—not on the website.

Sure, omnichannel commerce usually means multiple channels supporting each other, but in YaVendió’s case, that supportive role might be especially critical.

Now, who exactly needs this product?

The company intentionally doesn’t target small entrepreneurs just starting out. There are two reasons for that:

These small businesses don’t generate enough volume to require such a sophisticated tool.

The pricing is too steep for early-stage companies.

Instead, YaVendió targets established e-commerce businesses that spend over $2,000 per month on ads and find themselves in one of two situations:

They don’t currently use WhatsApp as a sales channel because the overhead makes it unsustainable. YaVendió gives these companies an additional, cost-effective channel.

They already use WhatsApp as a sales channel but seek to improve operational efficiency and reduce costs.

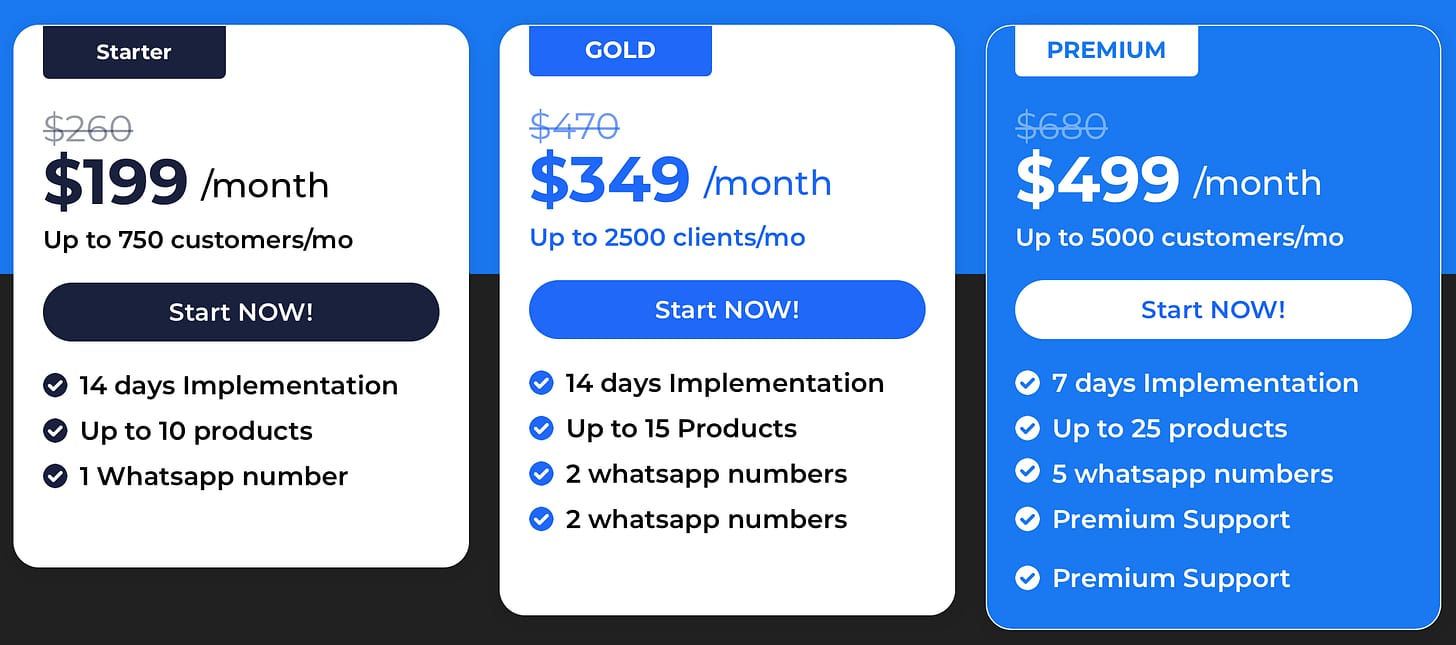

Monetization is straightforward—a monthly subscription ranging from $199 to $499, depending on the desired volume of customer interactions (from 750 to 5000 chats) and product listings (from 10 to 25 products).

Each subscription includes personalized implementation help since every company has unique sales flows and requirements. Additionally, clients receive 24/7 AI support, a conversion monitoring platform that allows for human intervention when necessary, and a lead classifier to identify which leads deserve the most attention.

The Local Angle

Since YaVendió is targeting the entire region, let’s also zoom out a bit and see which regional attributes enable a company like YaVendió to succeed.

WhatApp’s dominance

I’ve mentioned this before in the B4A piece, but it’s worth repeating: most Latin American countries spend a significant chunk of their day on social media—over 3 hours, compared to the global average of 2 hours and 21 minutes. And the most popular app by far is WhatsApp, with over 90% penetration in the region.

Sure, WhatsApp is actively used in many countries worldwide, but what makes Latin America special?

Two things.

First, the sheer embeddedness of WhatsApp in daily life. Users in Peru, Colombia, Argentina, and Brazil spend over 23 hours a month on WhatsApp, whereas the global average is around 16 hours. That’s a huge difference.

Second, WhatsApp plays a significant role in business. Three Latin American countries—Brazil, Mexico, and Colombia—made it into the top 10 for WhatsApp Business downloads.

The app is also directly involved in transactions: 6 out of 10 e-commerce buyers prefer interacting with stores not just through their websites, but via WhatsApp as well.

We also have some data (here and here) suggesting that Brazil, Mexico, Colombia, and Peru generate the most revenue through WhatsApp Business. While the data is a bit murky, it likely points in the right direction.

The point is, WhatsApp and WhatsApp Business specifically are really important for the region.

Popularity of social commerce

Social media is a big deal in daily life here, so it’s hardly a surprise that social commerce thrives too.

In Spanish-speaking Latin America, Mexicans and Colombians are particularly open to social commerce: between 40% and 50% are willing to buy clothes and beauty products directly through social media platforms.

More than half have already tried purchasing via social media, and over 20% even prefer social commerce to traditional e-commerce.

Businesses are naturally active too: according to YaVendió, around 450,000 businesses across Latin America engage in social commerce.

With the recent launch of TikTok Shop in Mexico and its planned expansion to other countries, social commerce will only grow. Although this particular event is not in YaVendió’s interest.

AI and Latin America

At first glance, Latin America doesn’t stand out as having high AI penetration. One easy-to-check metric is ChatGPT’s traffic, and we see only about 10% of it coming from Latin America.

But if we dig deeper into popular AI consumer apps, the picture starts shifting.

Take FaceApp, for example: Brazil and Mexico alone accounted for 13% of all its downloads. Even more notable is Character AI, with Mexico, Brazil, Colombia, and Argentina responsible for 29% of its downloads in the last 30 days.

And perhaps even more importantly, the Latin American population generally has a positive attitude toward AI. Let’s look at Mexico as an example:

64% believe that companies using AI will protect their personal data (global average: 47%).

While this isn’t comprehensive proof, these are definitely encouraging indicators for AI acceptance in the region.

The Roadblocks

Why won’t Meta do it?

Nobody knows Meta’s long-term plans for Llama, and WhatsApp itself has often been neglected. But Meta is actively developing an open-source LLM, and it’s easy to imagine them either building a YaVendió-like service or at least making it super easy (and free) for businesses to set it up themselves. Features like WhatsApp Flows already mimic transaction logic closely—though without the chatbot capability.

But as usual with questions like “Why won’t [X company] do it?”, the answer typically boils down to two things: either it’s just not a priority, or the market isn’t big enough to justify the effort.

SaaS penetration in Latin America

I’ve been struggling for a while now with whether low SaaS penetration is good (lots of room to grow) or bad (limited current market). At the moment, I lean toward the latter—because increasing adoption involves introducing new behaviors, which is notoriously hard.

Frustratingly, we don’t have reliable data on actual SaaS penetration among Latin American businesses, with estimates ranging wildly from 5% to 70%. We do know that 60% of SMEs in the US use vertical SaaS, while every other developed nation is under 25%, including Germany at 5%. Given that Germany’s B2B software market is five times bigger than Mexico’s, I’d guess actual penetration is around 5% or even lower.

Marketplaces control the market

Marketplaces have driven e-commerce growth globally, and Latin America is no exception.

Take Mexico, where Mercado Libre, Amazon, Walmart, and Liverpool now control 49.1% of the market—up from 40% in 2021.

Even though overall e-commerce continues to grow, you probably don’t want to be stuck in the shrinking portion of the pie.

Conversion question

I do wonder what happens to conversion rates when you replace humans with bots, especially in a region that values personalized interactions so highly. I don’t think we’re quite at the stage yet where people are fully comfortable talking to a bot, no matter how smart it is.

Limited industries

I suspect this product fits best in industries with frequent but non-subscription-based purchases. Groceries are a good example: your monthly basket rarely changes much, and you usually buy specific items, like milk with a certain fat percentage.

The Upside

AI belief

If you believe AI will shape the next industrial revolution, being early to the game pays off. Sure, widespread adoption might still be 3-7 years away, but that gives you time to smooth out all the kinks and enhance features.

Self-improving product

It sounds cliché, but as underlying AI models improve, YaVendió’s product automatically becomes better. The more data they gather, the better they understand customer journeys, industry-specific inquiries, and how to boost conversion rates. Better conversions lead to improved lifetime value, and everyone’s happier.

A (relatively) easy expansion

Most Latin American countries speak Spanish (with some regional variations), share similar cultures, and face comparable business challenges. All these factors simplify regional expansion.

YaVendió’s Latin America-wide focus is justified here, and it’s clearly a significant advantage.

Focus

On the other hand, being focused on a single dimension of the market, i.e., e-commerce, is a real strength. There’s a temptation to create a bot for every business on WhatsApp out there. YaVendió refuses that temptation and, from all the interviews I saw, is very much set in its ways. And if you aren’t a well-capitalized behemoth, focus is always a good thing.

The Takeaway

My takeaway from all of this is actually about WhatsApp. It’s so weird that you can build a business on the app and serve other businesses. But WhatsApp is also so far away from becoming a real platform, even something close to resembling WeChat (although it will never be WeChat for many reasons).

So you can kinda build your business on WhatsApp because you can communicate with the client and sell them something—but you also can’t rely on it solely because the functionality is very limited.